Federal Reserve officials left interest rates unchanged in their June decision and predicted they would cut borrowing costs just once before the end of 2024, a sign they plan to be patient before making a U-turn in their fight against rapid inflation.

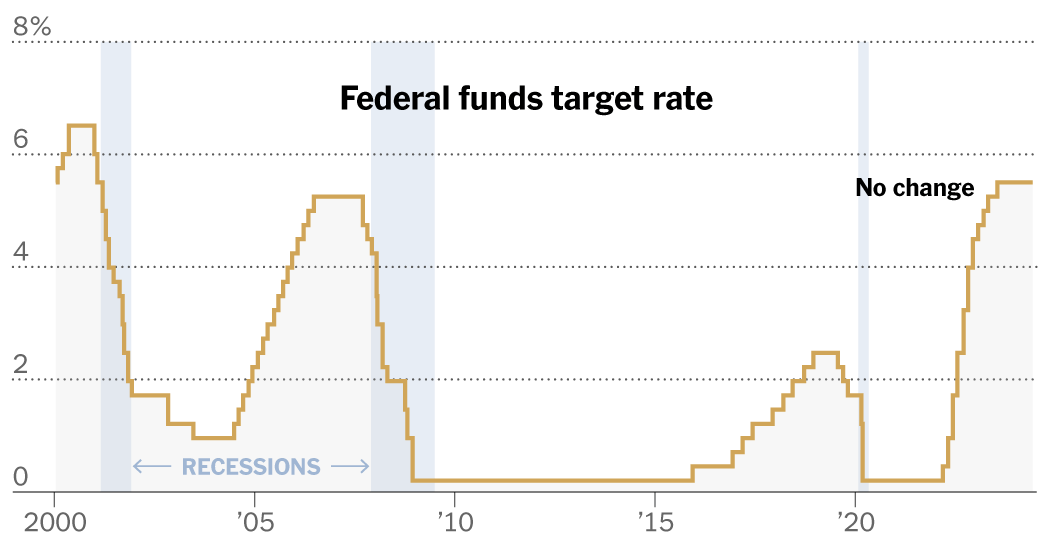

Central bankers raised interest rates rapidly between early 2022 and July 2023, taking them to a two-decade high of 5.3 percent. They have held them steady ever since, hoping that higher borrowing costs will slow consumer and business demand enough to quell the rapid rise in prices.

Inflation slowed steadily in 2023, falling enough that Fed officials entered 2024 expecting to cut interest rates three times this year. But then rising prices proved surprisingly stubborn at the start of the year – and policymakers had to delay their plans to cut rates, for fear of cutting borrowing costs too early.

Now that picture is in the process of changing again. Fresh consumer price inflation index data released on Wednesday reaffirmed that the pick-up in inflation in early 2024 was a speed bump rather than a change in trend: Price increases were especially invited in May. But it is getting too late in the year for the Fed to pull back on the trio of rate cuts they had expected until March, the last time policymakers released economic forecasts. Officials predicted in their new forecast on Wednesday that they would cut rates just once, to 5.1 percent, before the end of 2024.

Fed officials gave no clear indication of when rate cuts will begin. They meet four more times this year: in July, September, November and December.

Jerome H. Powell, chairman of the Fed, said during a news conference after the release that officials are still looking for “greater confidence” that inflation is moving steadily to 2 percent before cutting rates.

“The economic outlook is uncertain,” said Mr. Powell. “We remain very mindful of inflation risks.”

Mr Powell explained that moving policy “too soon or too much” could result in a reversal of inflation progress, but that moving too late or too little could “unnecessarily” weaken economic activity. He made it clear that the Fed’s new forecasts are not a firm plan or decision – things can change.

The Fed’s single rate cut forecast may come as a surprise to investors and economists, many of whom had expected the Fed to target two more cuts before the end of the year. But the major revision came as Fed policymakers took a broader turn toward greater caution. The Fed’s forecasts showed that officials expect inflation to turn out to be more stable than they had previously predicted in 2024: Headline inflation could end the year at 2.6 percent, they predicted, down from 2.4 percent in their previous estimate. Central bankers also predict that the unemployment rate could rise slightly more next year than they had previously predicted.

Policymakers adjusted their statement to reflect that price increases have started to cool again after stalling earlier in the year.

“In recent months, there has been modest further progress toward the committee’s 2 percent inflation objective,” the Fed said in a statement.

Mr Powell suggested the Fed’s inflation forecasts were “conservative”.

“We welcome today’s reading and hope for more like it,” said Mr. Powell.

While the overall picture painted by the Fed’s economic projections was cautious, it had its silver lining.

Policymakers predicted that growth would be sustained even as rates remained higher this year. And Fed officials expected to cut interest rates more quickly next year, suggesting that some of the rate cuts they had originally planned to make in 2024 were simply being postponed. They now expect to make four rate cuts in 2025, down from three previously. Rates were expected to end 2026 at 3.1 percent, unchanged from the March estimate.

But the Fed raised its forecast for where interest rates will be set in the longer term. The long-term interest rate is a rough estimate of the setting that will keep the economy operating at an even level over time, so if rates are above it, you’d expect them to slow the economy, and if they’re below it, you would expect. to speed it up. Officials now see the long-term “neutral” setting at 2.8 percent, up from 2.6 percent previously, suggesting that today’s policy setting is curbing growth a little less aggressively than previously understood.